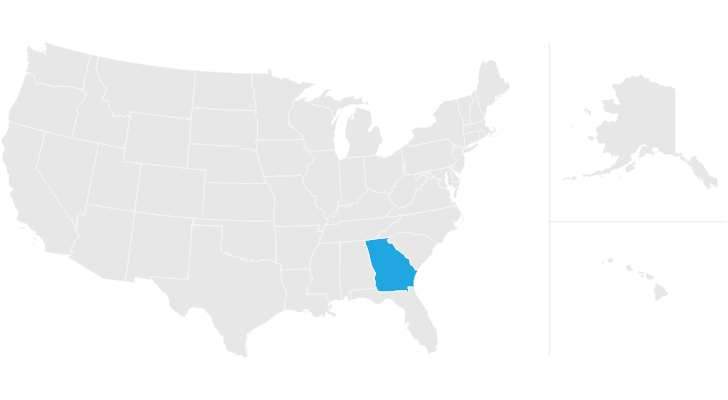

does georgia have estate or inheritance tax

But 17 states and the District of Columbia may tax your estate an inheritance or both according to the Tax. 1 A capital gains tax is a tax on the proceeds that come from the sale of property you may have received.

Estate Planning Duluth Ga Hollingsworth Associates Llc

No Georgia does not have an inheritance tax.

. New Jersey finished phasing out its estate tax at the same time and now only imposes an inheritance tax. The law does not forgive any tax liabilities interest or penalties associated with an estate whose owner died prior to January 1 st 2005. Most states have been moving away from estate or inheritance taxes or have raised their exemption levels as.

Washington Oregon Minnesota Illinois New York Maine Vermont Rhode Island. Its paid by the estate and not the heirs although it could reduce the value of their inheritance. So Georgians are only responsible for federally-mandated estate taxes in cases in which the deceased and.

Some states do have their own inheritance taxes and if you own property in one of those states such as real estate the. No there is no Georgia estate tax. A court-approved executor holds a probated estates assets and transfers them by executors deed to beneficiaries named in the decedents will.

Suppose the deceased Georgia resident left their heir a 13 million worth of an estate. Georgia has no inheritance tax but some people refer to estate tax as inheritance tax. Most states have been moving away from estate or inheritance taxes or have raised their exemption levels as estate taxes without the federal exemption hurt a states competitiveness.

A federal estate tax is in effect as of 2021 but the exemption is significant. The estate tax is different from the inheritance tax. As of July 1 2014 Georgia does not have an estate tax either.

Georgia law governs estate property transfers after someone dies. An inheritance tax is a tax on the property you receive from the decedent. Does Louisiana Have an Inheritance Tax.

Whether youre an executor newly in charge of handling a complex estate left by a business owner or youre a family member concerned about losing an unnecessary amount of your inheritance to Georgia and federal estate taxes you probably. As of July 2014 estates in Georgia no longer have to file estate tax returns or pay estate taxes. Federal Estate and Gift Tax Exemptions.

4 The federal government does not impose an inheritance tax. However it does not liberate Georgia residents from the Federal Estate Tax if the inheritance exceeds the exemption bar of 1206 million. Georgia has no inheritance tax.

And both federal and state governments can apply estate taxes which are levied against the assets that are bequeathed. Estate taxes also called inheritance taxes are the taxes paid on the assets left to the family of a deceased person. The tax is paid by the estate before any assets are distributed to heirs.

Georgia has no inheritance tax but some people refer to estate tax as inheritance tax. It is not paid by the person inheriting the assets. Georgia Inheritance Tax and Gift Tax.

Any deaths after July 1 2014 fall under these rules. Impose estate taxes and six impose inheritance taxes. In addition to the federal estate tax with a top rate of 40 percent some states levy an additional estate or inheritance tax.

Inheritance taxes also known as estate taxes are the taxes paid on the property left to the heirs of a deceased person. Even with this welcome benefit there are some returns that must be filed on behalf of the decedent and their estate such as. Idaho does not currently impose an inheritance tax.

It is not paid by the person inheriting the assets. The tax is paid by the estate before any assets are distributed to heirs. Does Georgia Have an Inheritance Tax.

However there will be occasions when a formal probate proceeding is unnecessary to transfer real estate to heirs or beneficiaries. There is no inheritance tax in Georgia. And yes both types of taxes are levied by Maryland and New Jersey although New Jersey will only have an inheritance tax for 2018.

Does Georgia have an inheritance or estate tax. The amount paid to Georgia is a direct credit against the federal estate tax. En español Most people dont have to worry about the federal estate tax which excludes up to 1206 million for individuals and 2412 million for married couples in 2022 up from 1170 million and 2340 million respectively for the 2021 tax year.

Twelve states and Washington DC. The Federal Estate and Gift Tax limits the amount one can transfer without incurring the tax. Only 11 states do have one enacted.

Estate taxes are only mandated in a handful of states and thankfully there is no Georgia inheritance tax. 2 An estate tax is a tax on the value of the decedents property. Inheritance taxes are applied to a persons heirs after they have already received money from someone who recently died.

The amount paid to Georgia is a direct credit against the federal estate tax. Maryland is the only state to impose both. Any deaths after July 1 2014 fall under these rules.

And both federal and state governments can apply estate taxes which are levied against the assets that are bequeathed. There are 12 states that have an estate tax. As of 2014 Georgia does not have an estate tax either.

A Quick Simpler Prime about Georgia Inheritance Tax. Do you have to pay taxes on inheritance money in Georgia. Inheritance taxes are only in place in some states and Georgia is not one of them.

Also called a death tax the estate tax is the final round of taxes someone pays before their property is distributed to their heirs. However this privilege only applies to estates whose decedents passed away before January 1 st 2005. 117 million increasing to 1206 million for deaths that occur in 2022.

It does not matter to the IRS whether the wealth is transferred as a gift or upon death. New Jersey Nebraska Iowa Kentucky and Pennsylvania. Another states inheritance tax could still apply to Georgia residents though.

Understanding Georgia inheritance tax laws and rules can be overwhelming. Georgians are only accountable for federally-mandated estate taxes in cases in which the decedent and their beneficiaries live in Georgia. In 2014 OCGA 48-12-1 went into effect eliminating estate taxes at the state level.

Delaware repealed its estate tax at the beginning of 2018. Seventeen states have estate taxes but Georgia is not one of those either. No Georgia does not have an estate tax or an inheritance tax on its inheritance laws.

Just five states apply an inheritance tax. Nevertheless you may have to pay the estate tax levied by the federal government. Real Simples recent article entitled Heres Which States Collect Zero Estate or Inheritance Taxes explains that inheritance taxes are levies paid by the living beneficiary who gets the inheritance.

In this case 940000 would be subject to a Federal Estate Tax.

Taxation In Georgia No More Tax

Georgia Estate Law Faulkner Law

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Georgia Estate Tax Everything You Need To Know Smartasset

Georgia Inheritance Laws What You Should Know Smartasset

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Georgia Estate Sales Real Estate In Ga Estate Planning Infographic Estate Planning Estate Planning Checklist

Complete Guide To Probate In Georgia

Georgia Inheritance Laws What You Should Know Smartasset

Georgia Estate Law Faulkner Law

How Long Does Probate Take In Georgia Gplg

What You Need To Know About Georgia Inheritance Tax

Estate Trust Tax Preparation Atlanta Marietta Peachtree Corners Ga Certified Cpa

Georgia Estate Tax Everything You Need To Know Smartasset

Georgia Estate Tax Everything You Need To Know Smartasset

Guide To Georgia Inheritance Law The Law Office Of Paul Black

Watch Mail For Debit Card Stimulus Payment Prepaid Debit Cards Debit Card Visa Debit Card